When taking out a loan to buy a rental property, it is important to understand the financing option that you are getting. This is especially true for non-conventional loans.

Now, one type of mortgage loan that not many people are familiar with is the DSCR loan. This type of loan makes it possible for investors to finance a rental property without needing to provide any personal guarantee or collateral. It can be quite advantageous since it does not require you to put up any additional assets other than the actual house being purchased.

So, if you are considering buying a rental home and would like to educate yourself about DSCR program details, then read on!

What Is a DSCR Loan Program

DSCR stands for “debt service coverage ratio”, which is a loan metric used by DSCR lenders when considering a borrower’s ability to repay their mortgage. It is calculated by dividing the net operating income (NOI) of the rental property by its total debt service (TDS).

So, for example, if an existing rental property for sale has an NOI of $20,000 and a TDS of $15,000, then the DSCR would be 1.33 ($20,000 divided by $15,000). Generally speaking, lenders prefer to see at least a DSCR of 1.2 or higher before approving a loan for purchase. This means that your NOI should be at least 20% higher than the total debt service. So, you will have enough to cover the loan payments, while still having some extra income left over for other expenses.

As previously implied, a DSCR service coverage ratio program is unique in that it does not require you, as the borrower, any personal guarantee or collateral beyond the actual real estate being purchased. This makes it appealing for investors as you do not need to put up additional assets in order to secure financing.

However, you should keep in mind that these types of loans can come with higher interest rates than other types of mortgages, with rates playing within the range of 7.9% to 10.1%.

Be that as it may, it is good to know there is no risk of default involved with this type of loan. As long as you do your due diligence in finding the best properties out there and maintaining steady occupancy rates, you should have no problems repaying the loan.

DSCR Program Requirements: Knowing Your Eligibility for This Loan

Like taking out any other type of mortgage, you should learn about DSCR program details before entering into an agreement. That way, you will know if this is the best financing option for your situation and be confident that you are making a sound financial decision.

Like Us on Facebook!

Generally speaking, there are two main DSCR program requirements when taking out this type of loan: the rental property’s DSCR and your down payment.

Subscribe Us on YouTube!

The Property’s DSCR

When you are hunting for rental properties, you should gather certain information to determine the DSCR of each one. This includes the current market rates, occupancy rates, TDS, and NOI.

You already know the formula for computing the DSCR and look for those with higher figures. While a DSCR of 1 means break-even, you should aim for higher DSCRs as lenders prefer those. A DSCR of lesser than 1, will make it very difficult—or even impossible—to get approved for your loan.

Besides making sure the numbers are in order, ask yourself if the property is located in an area where people want to live and rent out rooms. How does it compare with other properties in terms of amenities and features? Does it have any repairs or renovations needed? These factors will contribute to the amount of NOI you can expect, and thus determine the DSCR of the property.

Your Down Payment

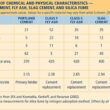

In addition to the property’s DSCR, you should also be aware of the down payment that you need to make. Most lenders require a minimum amount ranging from 20% to 25% of the total price of the house. However, this may differ depending on your financial situation, how much debt you already have, and the lender.

Having an adequate down payment is important as it reduces the lender’s risk if things do not turn out as planned and they end up having to foreclose on your loan. It also makes them more likely to approve it in the first place since you are showing them that you are financially capable of taking on such a venture.

When offering a down payment, it would be beneficial if you can pay it in cash as this will improve your chances of getting approved for the loan. Also, try to pay a higher amount than the minimum required, as this will demonstrate to potential lenders that you have a strong commitment to the purchase and are more likely to repay your loan on time.

Other Eligibility Requirements

Depending on the lenders, you may also need to meet certain prerequisites to get approved for a DSCR loan program faster.

Healthy Credit Score

Lenders might ask for a minimum credit score somewhere between 640 and 660. However, if you have higher credit scores, then you will likely get more favorable terms, such as lower interest rates.

Having a good credit score is also essential when taking out a DSCR program for property investors, as lenders will need to trust that you can handle your finances well enough to make the payments.

Rental Property Management Experience

It is also possible that lenders might ask if you have any experience in managing rental properties. This means that you should have prior knowledge about this type of business. Having some experience in this field could even help increase the amount of money they lend you or reduce the interest rate if applicable.

Proof of Income

Having some proof showing that you have a steady source of income can also be helpful. This could include tax returns, bank statements, and pay stubs. Having documents like these will further convince lenders to grant you the loan.

Good Financial Standing

Lastly, lenders often want to see that you are in good financial standing and have other investments or assets that can help support the loan. The rationale is that they do not want to take on too much risk with borrowers who may be unable to make their payments due to unforeseen circumstances.

Understanding the DSCR program details when it comes to requirements is the key to getting approved for a loan. Make sure that you understand all the aspects, do your homework on rental properties and lenders, and have the necessary documents at hand to get approved for your loan quickly.

DSCR Program Guidelines: Steps for the Application Process

Alt-Text: investor applying for a DSCR service coverage ratio program

Link: https://www.pexels.com/photo/person-wearing-white-dress-shirt-signing-contract-955390/

When you have established that you are eligible for a loan, it is time to start the application process. Here are the DSCR program guidelines that you can use.

1. Find a reputable lender that offers DSCR loans.

Not all lenders offer this type of loan program, so make sure that you shop around various lenders and look for the best terms. You should also research the lender and read online reviews to ensure that they are trustworthy and reputable.

2. Gather all necessary documents.

You will need to submit bank statements, tax returns, pay stubs, credit reports, proof of income, etc. to prove your financial standing and ability to make loan payments on time. Have these documents ready before applying for the loan as it may speed up the process of getting approved.

3. Understand the terms of the loan carefully.

Before signing any agreement or contract with your lender, be sure to understand all of its terms and conditions thoroughly. This includes knowing how much money you can borrow, what fees are included, and the repayment terms.

4. Submit your application.

Once you have all the documents ready and know what to expect from the loan, submit the application to the lender. The process of getting approved may take some time depending on how quickly they can verify your information and run a credit check.

5. Receive a decision.

After submitting your application, it is now up to the lender to assess if you are eligible for their DSCR loan program or not. Once they have reviewed everything, you will receive an email or letter with their decision within several days—or weeks in some cases.

Benefits of Taking Out a DSCR Loan Program

As long as you meet all the requirements mentioned above, there are several advantages that come with taking out a DSCR loan program.

No Need for a Perfect Credit Score

Since the lender will be lending you money based on the property’s income, they may not need to run a credit check in order to approve your loan. Therefore, this can be beneficial for people who have bad or no credit scores since it is easier to get approved for such loans compared to traditional mortgages.

More Flexible Repayment Terms

DSCR loan programs can also provide more flexible repayment terms compared to traditional mortgages. This means that you can negotiate with the lenders the length of time you have to pay out the entire loan or lower the monthly interest payments.

Ability to Finance Multiple Properties Simultaneously

Now, this might be the best perk that you will not get from other types of mortgages—DSCR loans will allow you to finance multiple rental properties simultaneously. This makes it easier to build up your property portfolio and grow your wealth faster.

Drawbacks of the DSCR Program

While a DSCR loan program can provide you with amazing benefits, you should also take note that it also comes with its own set of drawbacks.

You Cannot Use a DSCR Loan to Purchase a Primary Residence

There is a good reason why people refer to this type of loan as a “DSCR program for small businesses”. Designed only for investment purposes, it does not allow you to use its funds for purchasing a primary residence.

Lenders Might Charge Higher Interest Rates

Since a DSCR loan program is considered high-risk, lenders will often charge higher interest rates compared to traditional mortgages. This means that you may need to pay more money each month for repaying the loan.

It Could Come with Pre-Payment Penalties

Finally, some lenders might include pre-payment penalties in their DSCR loan contracts. This means that you may get charged if you decide to pay off the loan ahead of time. So, make sure to check the terms and conditions before signing any document.

Final Thoughts

Taking out a DSCR loan can be very beneficial if you want to purchase rental properties or expand your property portfolio quickly. However, it is important to understand all DSCR program details carefully before making any decisions. With the right lender and circumstances, this type of mortgage can greatly help achieve financial success without having to risk too much money upfront.

For more tips and information on real estate investing, you can check out the rest of our posts!